29 associations representing 99 percent of total UCITS and AIF assets provided us with net sales data.

The main developments in November 2016 can be summarized as follows:

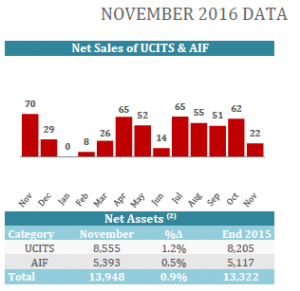

- Net inflows into UCITS and AIF totaled EUR 22billion, compared to EUR 62 billion in October.

- UCITS registered net inflows of EUR 9 billion, downfrom EUR 47 billion in October.

- Long-term UCITS (UCITS excluding money market funds) recorded net inflows of EUR 1 billion, compared to EUR 22 billion in October.

- Equity funds recorded net inflows of EUR 6 billion, compared to net outflows of EUR 1 billion in October.

- Net sales of bond funds recorded net outflows of EUR 8 billion, compared to net inflows of EUR 17 billion in October.

- Net sales of multi-asset funds decreased from EUR 6 billion in October to EUR 0.1 billion in November.

- UCITS money market funds recorded net sales of EUR 9 billion, down from EUR 25 billion in October.

- AIF recorded net inflows of EUR 13billion, down from EUR 15 billion in October.

- Total net assets of European investment funds increased to EUR 13,948 billion at end November, compared to EUR 13,817 in October and EUR 13,322billion at end 2015.

The anticipation of faster growth and higher inflation following the election of Donald Trump as American President had an impact on investor demand for UCITS in November: net sales of equity funds picked up, whereas net sales of bond funds turned negative for the first time since February 2016.